PwC response to Budget 2015 - Solving tomorrow's problems today

The following comments are responses from PwC Singapore to Singapore Budget 2015, organised into three categories – Competitiveness, Social spending and issues, Innovation.

The following comments are responses from PwC Singapore to Singapore Budget 2015, organised into three categories – Competitiveness, Social spending and issues, Innovation.

Professionally managed financial investments globally are predicted to grow at 6% per annum to reach $100 trillion by 2020, according to a new report by PwC. Exchange traded funds (ETFs) will pay a prominent role in this growth, as new investor segments continue to integrate them into their portfolios and fund sponsors continue to introduce more products.

After three years in development, the IAASB has released a set of standards that are game-changing for shareholders and the profession, says PwC. The standards mark a move to allow reports that are more informative, discursive and insightful. The new reports will undoubtedly stimulate enhanced conversations among auditors, companies, audit committees and shareholders.

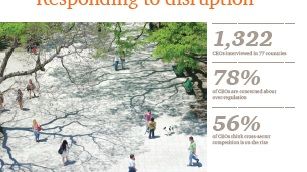

Fewer CEOs than last year think global economic growth will improve over the next 12 months, though confidence in their ability to achieve revenue growth in their own companies remains stable, say the more than 1,300 CEOs interviewed worldwide in PwC’s 18th Annual Global CEO Survey. Results of the survey were released at the opening of the World Economic Forum Annual Meeting in Davos, Switzerland.

A new PwC report-Digital advertising in Singapore: mind the gap — finds that there is a significant “media gap” here. Despite Singapore being one of the most digitally connected populations with the highest smartphone penetration (85%) in the world, the level of online advertising is well below international averages. Report suggests four inhibitors hindering the adaptation of online advertising.

PwC’s landmark report titled ‘Future of India – The Winning Leap’ was launched in Singapore at a breakfast briefing today.In attendance were Her Excellency Ms Vijay Thakur Singh, Indian High Commissioner to Singapore, Yeoh Oon Jin, Executive Chairman, PwC Singapore, Shashank Tripahti, Strategy Leader,PwC India, and leaders from the local and India business communities.

PwC Singapore and the Singapore Business Federation (SBF) jointly organise roundtable for business leaders in Singapore

Singapore is viewed favorably in terms of investment and development prospects next year, according to Emerging Trends in Real Estate® Asia Pacific 2015, a real estate forecast jointly published by the Urban Land Institute (ULI) and PwC. However, its ninth place ranking – down from seventh place in 2014 – indicates that it has lost some of its appeal for investors, according to the report.

PwC Singapore today released a set of recommendations which were provided to the MOF and MAS for consideration in relation to the upcoming Singapore Budget 2015. As Singapore celebrates her 50th birthday, Budget 2015 should be a pillar for the next 50 years of Singapore’s growth and development.Measures that have served Singapore well will need to evolve in the light of today’s environment.

India is on the cusp of major change. PwC’s landmark report titled ‘Future of India – The Winning Leap’ launched today in India revealed the winning solutions required to lead India to unprecedented economic growth coupled with radical improvements in the Human Development Index (HDI) over the next two decades.

Now in its tenth year as part of the World Bank Doing Business project; Paying Taxes is a unique study which investigates and compares tax regimes across 189 economies, ranking them according to the relative ease of paying taxes. The report is expected to be a catalyst for discussion with tax authorities, governments, and businesses about tax systems and how they can be reformed. Singapore ranks 5

Confidence among CEOs in Asia Pacific continues to get stronger, a new report by PwC finds. 46% of executives in the region now say they are “very confident” of growth in the next 12 months, up 10 points from 2012 and 4 points from last year, despite slowing growth in China. Study also finds China, US, Indonesia, Hong Kong-China, Singapore top investment destinations.