Press release -

PwC: Significant “media gap” exists in Singapore

News release

| Date | Tuesday, 16 December 2014 |

| Contact |

Candy Li Tel: +65 6236 7439 Mobile: +65 8613 8820 E-mail: candy.yt.li@sg.pwc.com |

| Pages | 1 of 4 pages |

PwC: Significant “media gap” exists in Singapore

Singaporean businesses are missing key opportunities to reach audiences online

Singapore, 16 December 2014 – A new PwC report — Digital advertising in Singapore: mind the gap — finds that there is a significant “media gap” here currently. Despite the fact that Singapore is one of the most digitally connected populations with the highest smartphone penetration (85%) in the world, the level of online advertising in the country is well below international averages.

The report surveyed top marketing and media agency executives via interviews, and findings suggest that there are four inhibitors that hinder the adaptation of online advertising — poor understanding of measurement metrics online, limited supply of “digital” talent, slow mindset shift and relative ease of using traditional media channels.

Media gap in Singapore

With Singaporeans spending an average of 40% of their time on online media each day, Singapore has the highest rate of digital consumption in the world. This make makes the low digital spend — one of the lowest proportions among developed countries — all the more surprising.

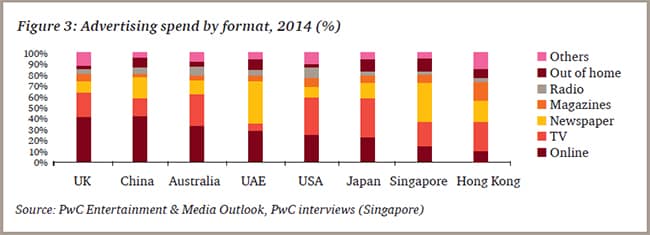

Although the proportion of advertising budgets allocated to online has grown rapidly, climbing from just 7% in 2011 to 15% in 2014 with a compound annual growth rate of 35%, Singapore is still far behind the United Kingdom, China, Australia, United Arab Emirates, USA and Japan as seen in the diagram below:

Greg Unsworth, Technology, Media and Telecommunications Industry Leader, PwC Singapore said:

“There is potential for a surge in adoption of digital advertising in Singapore, given industry changes, evolving technology, and the government promoting its Smart Nation initiatives. Increasingly, all companies are taking steps to becoming more digitally-enabled. Bridging the media gap with consumers can potentially allow companies to unlock efficiencies and increase their competitive advantage.”

Inhibitors of online advertising

Through the interviews, four common challenges that stifled the industry from taking the leap are:

● poor understanding of measurement metrics (68%),

● limited supply of “digital” talent (64%),

● slow mindset shift in education (59%) and

● relative ease of using traditional media (45%).

Poor understanding of measurement metrics – Digital marketing has the advantage of measuring data; however this may lead to information overload. Marketers struggle to filter the plethora of data into a “killer business metric”, making it too difficult for senior management to interpret. The industry will need time to get used to measuring online data and integrating it with traditional media metrics.

Limited supply of “digital” talent – Digital advertising requires both analytical and creative skills. There is a shortage of citizens with this depth of talent in Singapore and as a result of this, marketing teams, agencies and tech companies are competing for talent. The dilemma of upskilling versus importing proven talent is an ongoing challenge.

Slow mindset shift in education – The willingness to learn and having a different way of managing communication is key to digital marketing. The industry is moving away from traditional campaigns “bursts” to “always-on” strategies – ongoing processes of engagement, analysis and refinement. The Board and other stakeholders have to be bought-in to this fundamentally new way of connecting with consumers for the shift to happen.

Relative ease of using traditional media - Singapore stands out amongst its international peers for its highly consolidated traditional media landscape. As such, the industry tends to use traditional media as their default avenue, with simpler relationship and pricing structures. By comparison, online media is seen to be more complicated requiring multiple relationships, greater effort, and more risk venturing into the unknown.

Closing the gap

The following four approaches may help businesses close the “media gap” in Singapore:

Developing meaningful business metrics for digital

With the volume of information, knowing which KPIs to track is an important step. Companies can map their key business objectives and understand the digital levers associated with each of these objectives in order to prioritise the metrics that matter – sales revenue, cost savings, customer satisfaction. For example, digital reach and web traffic can impact store sales. After the key objectives and online levers are defined, companies need to establish baselines as a starting point and set goals against each measure for tracking purposes.

Publishing this information into an employee appraisal that is easily interpreted by management on a regular basis helps educate and drive a common language across the business with digital as a part.

Lastly, media agencies, media owners and industry bodies such as the IAB (Interactive Advertising Bureau), SiTF (Singapore Information Technology Federation) or SRA (Singapore Retail Association) should provide benchmarks on industry relevant KPIs to monitor competitor metrics.

Talent strategies to integrate digital competency into the workforce

For companies unsure of which talent to prioritise, an option, in the early days, is to consider increasing digital leadership by hiring a ‘Chief Digital Officer’ (CDO), mandated to drive the digital charge across digital media and digital customer experience for the organisation.

At the same times, companies should start to both upskill and import talent. For companies seeking a more ‘accelerated’ approach to embracing digital, importing talent is by far the fastest way to drive change. Companies should focus on importing highly specialised roles such as search experts, data analysts and social media managers. Over time, these roles will evolve into media performance experts, business managers and community managers.

For companies who choose to upskill their staff, here are some possible solutions:

1. Secondments or job swaps: Import talent from either marketing partners, or from more advanced digital markets and embed them in the organisations network into client marketing departments to drive on the ground learning.

2. Internships: Immerse digital native undergrads or post-grads onto live projects to kick start and inject know-how and fresh thinking into marketing teams. The Singapore Government has offered support for Company Led Training (CLT) programs in the past and this is an option worth exploring.

3. Industry training and certification: Develop programs either online or face to face to equip marketers with confidence, access to a community and meaningful qualifications.

Top down executive support for digital

Most organisations that have yet to embrace digital are facing systemic challenges internally, mainly around risk adversity. Here are some additional protocols that can be put in place to support change and experimentation:

1. Top down mandates:Unless someone is held accountable at Executive Management or Board level, the chance of driving a meaningful shift to digital is highly unlikely. Organisations who have stated explicitly in their Board letters a planned move to digital, grounded in commercial value, have very often been successful in realising that change. Setting targets for the proportion of digital media investment in advertising expenditures creates a clear goal for teams and increased accountability for delivering progress.

2. Culture of learning: Innovation programs can come in many forms, including the well-known 70-20-10 Model born in the 1960s and adopted by many multi-nationals including Coca-Cola. About 70% of their investment is in “Now”, or established and successful programs; 20% goes to “new”, or emerging trends that are starting to gain traction; and 10% goes to “next’, ideas that is completely untested. This approach enables companies to start small and scale fast.

Developing more integrated media strategies

Digital media owners need to make it easier for advertisers to include their solutions in the media mix, equipping media planners with the tools and training to integrate digital into campaigns and budget planning. These could be in the form of new media planning platforms and tools or industry and audience benchmarks. It is also the responsibility of the advertisers to demand more of their agencies to develop a robust media mix model for their business.

Digital media owners need to better educate advertisers and agencies on the next generation of digital platforms. Enterprise media-buying solutions otherwise known as “programmatic buying” are significantly simplifying the way in which digital and increasingly traditional media can be bought and managed. These sophisticated platforms enable advertisers to reach hyper-targeted customers across thousands of digital publishers, and are fast becoming a discussion point for sophisticated advertisers who see ownership of these platforms and the associated data as a source for competitive advantage.

Digital advertising stakeholders (advertisers, agencies, media owners and industry bodies) have a significant role to play to enhance the ecosystem. While advertisers will inevitably change their mindset on digital platforms, media agencies need to support this change by providing more robust digital solutions, with a scientific impact assessment. The media owners would have to make implementation easier by simplifying the options and usage terms. Industry bodies and government will need to continue to play their role in coordinating and consolidating efforts. More importantly, all stakeholders will need to come together to help develop online advertising in Singapore.

Concluded Greg Unsworth, Technology, Media & Telecommunications Leader, PwC Singapore,

“Although Singapore is lagging behind its peers in digital advertising, the industry is aware of this and the gap is closing. More must be done to counter the four key inhibitors as the nation heads towards becoming a Smart Nation enabled by technology. The increasing importance of mastering digital will become more apparent and companies that lag behind will risk losing their market share. At current growth rates by 2017, digital advertising could represent 34% of total media advertising spend in Singapore.”

−ENDS−

NOTES TO EDITOR

About the report

In order to understand the media gap in Singapore, Google Asia Pacific commissioned PwC to prepare this independent report. The results have been discussed with Google executives, but PwC is responsible for the analysis and conclusions. We interviewed top marketing and media agency executives in Singapore from June to August 2014. Interview topics included advertising mix by media type, online advertising mix, inhibitors of digital spend and growth opportunities for online advertising. The focus was on online advertising spend in the telecommunications, retail, and financial services industries for the purpose of this study. Both Google Asia Pacific and PwC are pleased to present these findings in order to provide a better understanding of the media gap in Singapore.

Related links

Topics

Categories

About PwC

PwC helps organisations and individuals create the value they’re looking for. We’re a network of firms in 157 countries with more than 184,000 people who are committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2014 PricewaterhouseCoopers. All rights reserved.